Salary Deduction

Salary sacrifice and deduction schemes to help your people stretch their pay

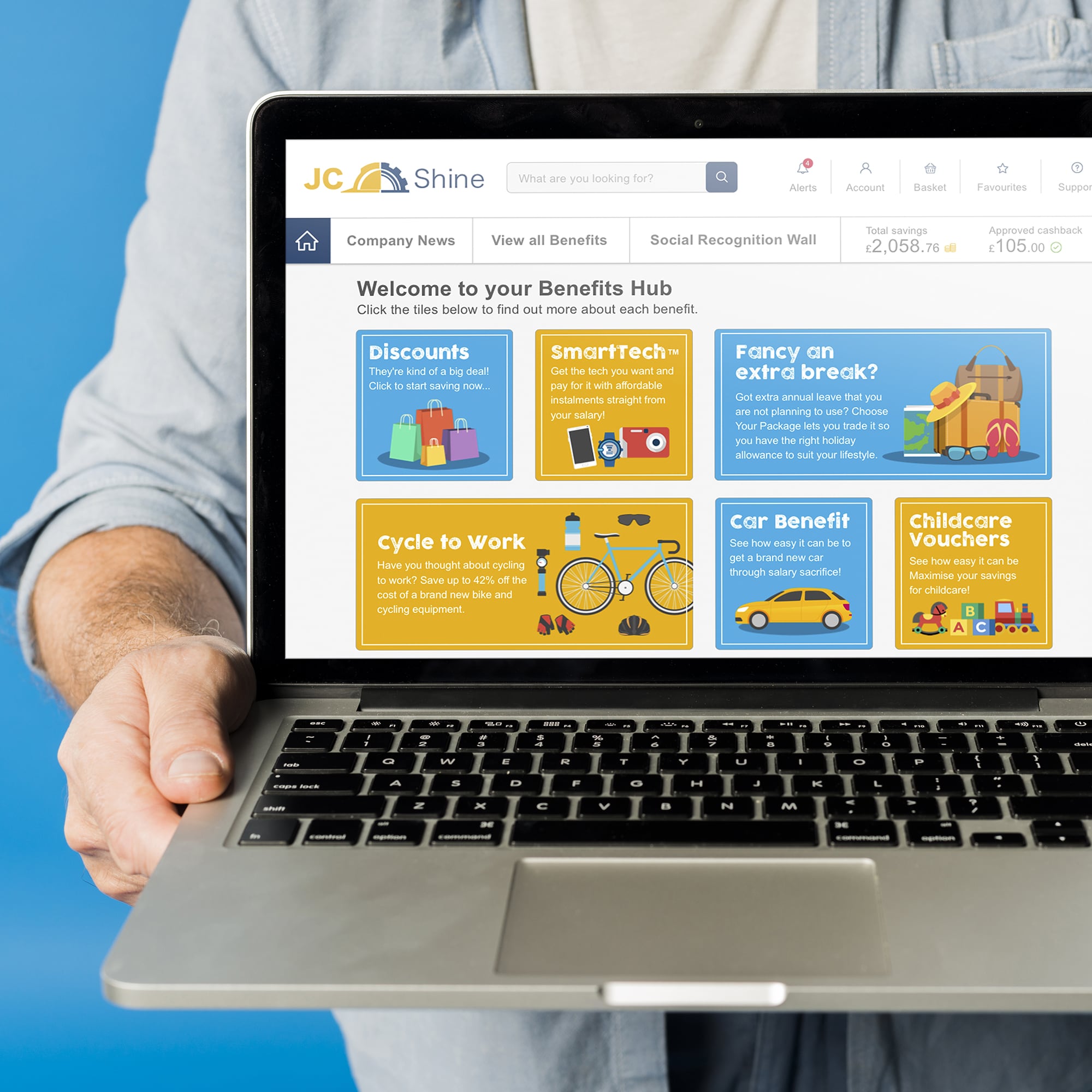

Support your people’s financial wellbeing and save them money on product or service purchases through a Reward Gateway | Edenred salary sacrifice or net deduction scheme. These employer-branded programmes are integrated into your benefits portal, with minimal overhead costs, and can offer National Insurance savings that can help you fund other benefits or HR initiatives.

We make salary sacrifice and net payroll deduction easy

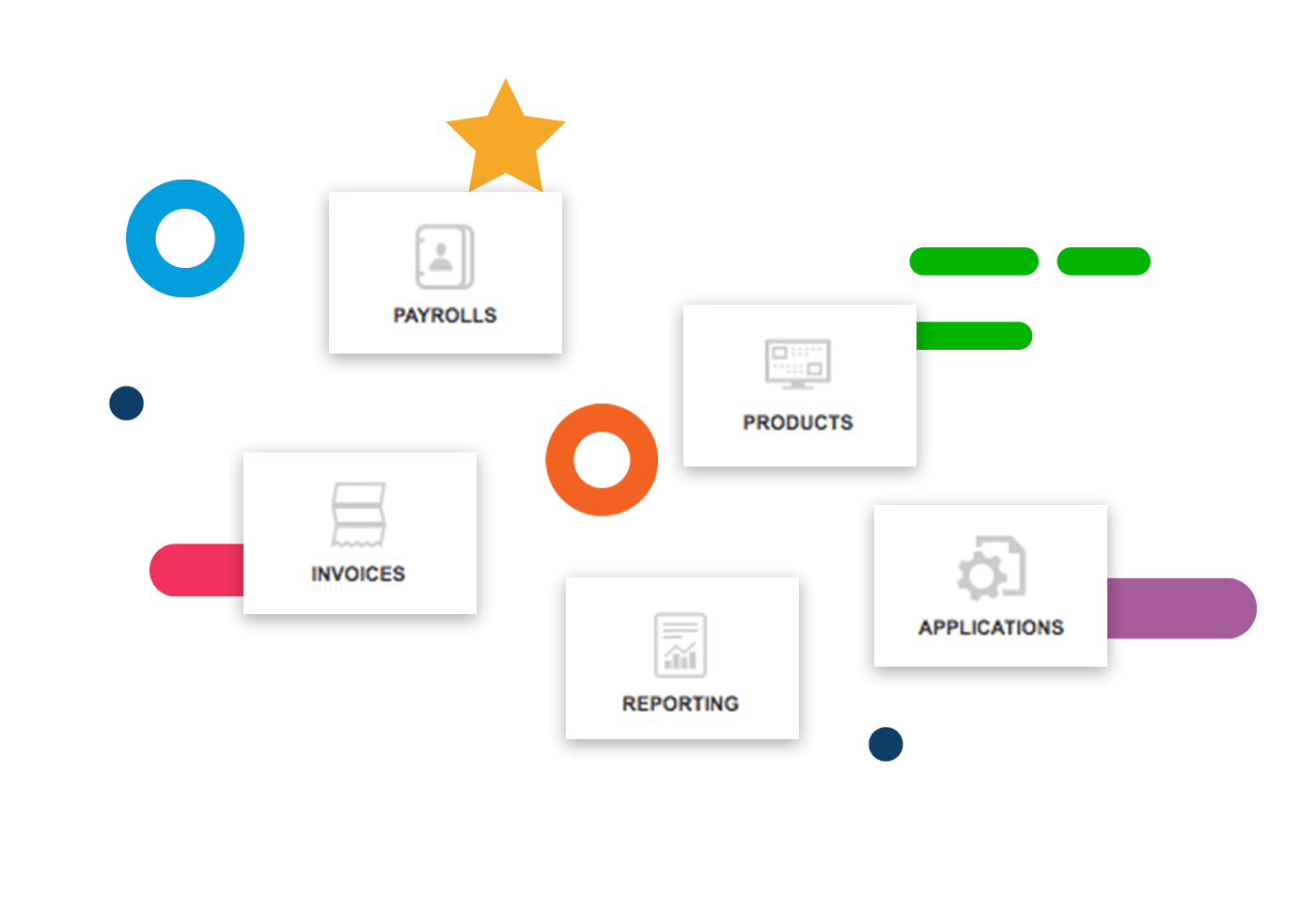

Streamline and simplify your salary sacrifice and net deduction benefits with Reward Gateway | Edenred's exclusive central administration hub. You’ll enjoy:

Automated pre-approval option

Eliminate admin with auto-approval options for any of our salary deduction or net payroll deduction benefits, along with pre-defining company limits and allowances.

Centralised benefit payrolls

Create your payroll just once, and reuse across any Reward Gateway | Edenred salary sacrifice or net deduction products.

Easy window management

Your HR and payroll admins have visibility over current or scheduled windows for benefits through Reward Gateway | Edenred. Manage these from one place with a simple drag and drop calendar.

Fast, flexible offerings that make a meaningful difference

Automatic approvals ensure employee applications are approved instantly taking into account any active submissions and executing automatic affordability checks on each employee, saving HR administration time, and getting support to your employees faster. Our salary and net payroll deduction programmes include:

SmartTech™

FSupport your people through purchases of the latest technology and whitegoods from CurrysCycle to Work

Promote a healthier lifestyle and help employees save money on bikes, e-bikes and equipmentCar Benefit

Offer access to a new or preloved car or electric vehicle from Tusker, and save on NIChildcare Vouchers

Maximise parents’ savings and support financial wellbeingHoliday Trading

Allow eligible employees to trade in holiday allowance for cash or exchange cash for extra daysEasy administration with one benefits portal

The Reward Gateway | Ednred benefits administration platform makes delivery of salary sacrifice and payroll deduction benefits fast and simple. If you have more than one payroll deduction product (e.g. Holiday Trading, Cycle to Work, Childcare Vouchers) with Reward Gateway | Edenred, manage them easily from one place.

Get support on your engagement journey

Our clients love how easy our programmes are to administer and manage, but no matter how big (or small) your team is, we’re here to help you on your journey. From a dedicated Client Success Manager to an implementation team and 24/7/365 employee support available, we’ll be by your side to help your employee benefits schemes succeed. Through your benefits portal, we’ll provide you with a deduction report every payroll period to help reduce administrative burden.

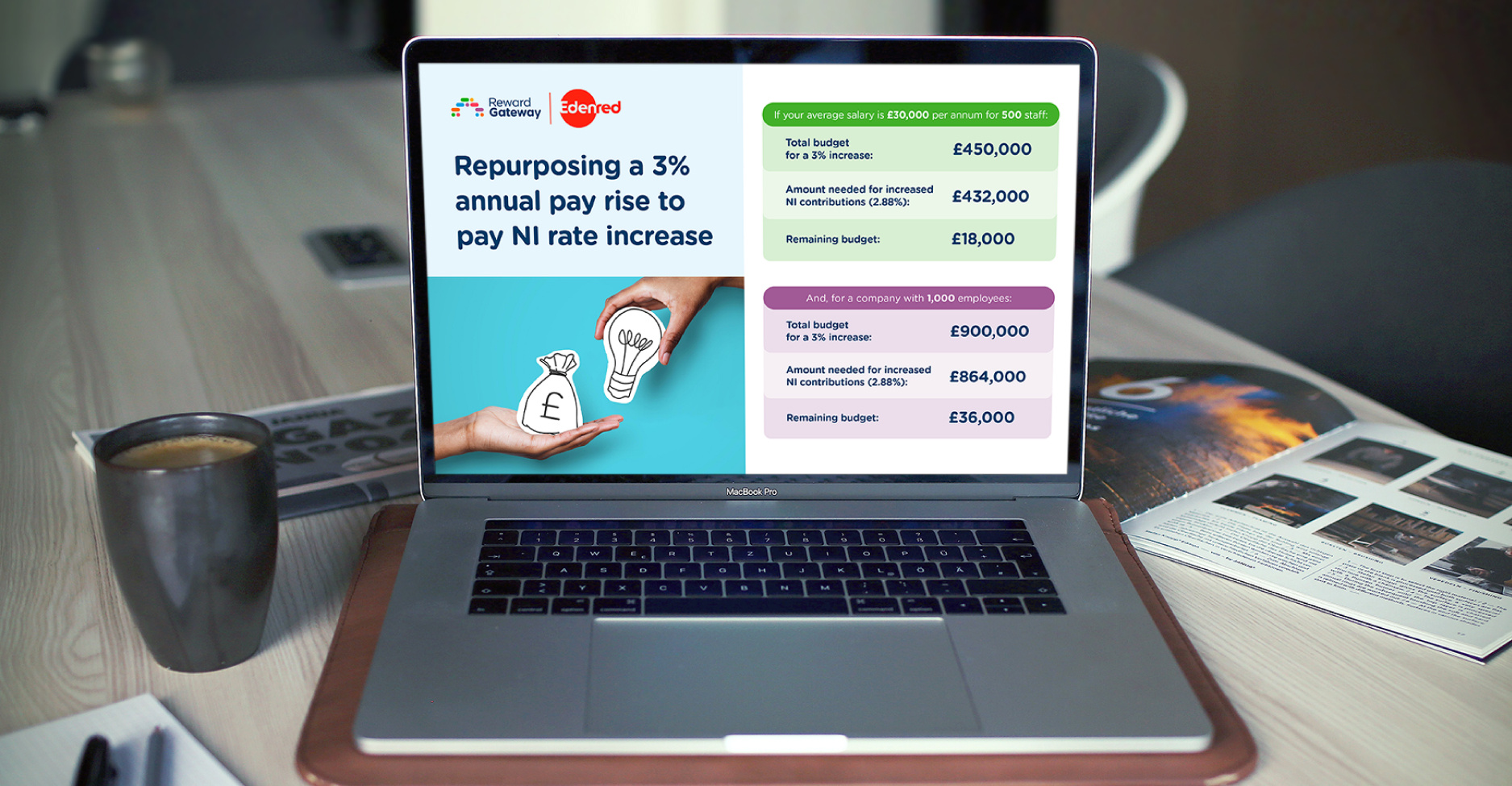

Featured eBook

Stretching Pay: Tackling NI Increases

Discover how repurposing a 3% pay rise can offset National Insurance increases and unlock more than £500 in savings per employee annually with industry-leading discounts and benefits.

"Our offline employees love that they can apply for salary sacrifice options on any device, at any time through our engagement hub. It's especially helpful to have a 24/7/365 helpdesk number in case employees have questions when we're not around."

Discover more Reward Gateway | Edenred client success stories

![[Client Testimonial] DB Cargo](https://www.rewardgateway.com/hs-fs/hubfs/00-Product-Assets-New/UK/Testimonial-mockups/db-cargo-mockup.png?width=4168&height=3176&name=db-cargo-mockup.png)

Salary sacrifice/deduction FAQs

How do salary sacrifice benefits work?

The deductions/repayments are from the employees Gross annual salary (before tax pay) and result in tax and national insurance (NI) savings.

How do salary deduction benefits work?

The deductions/repayments are from the employees Net annual salary (after tax pay).

What is the difference between salary sacrifice and salary deduction?

A salary sacrifice benefit offers tax advantages as they reduce an employee's taxable pay before tax and National Insurance calculations while the salary deduct schemes are cost-neutral, and do not offer additional savings but are an interest and debt-free alternative to loans and credit cards.

What happens if an employee leaves with an outstanding salary sacrifice/deduction balance?

If the employee leaves before they’ve fully repaid a benefit, they must pay their employer the balance of the amount outstanding. This should be deducted from their final net pay (regardless if it’s a gross or net benefit).

How does salary sacrifice work with employees on National Minimum Wage?

Some payroll benefits, such as Cycle to Work, are available through a salary deduction method. While employees on or below NMW are not eligible for salary sacrifice, they are eligible for salary deduction. This is where deductions from them are taken from their net salary, ensuring their pre-tax salary doesn’t go below the NMW level.