Holiday Trading

Holiday Trading offers choice to suit everyone's lifestyle

Holiday Trading is a benefit that allows eligible employees to trade in holiday allowance for cash or exchange cash for extra days of holiday. Empower your employees with a flexible holiday calendar that supports a healthy work-life balance and champion an engaged, happy and positive workforce with our annual leave purchase scheme.

Boost your overall Employee Value Proposition with a benefit to make your people smile

Centralise salary sacrifice benefits

Administer Holiday Trading alongside your other salary sacrifice benefits in one, centralised platform

Boost employee productivity

Give your employees a choice in what motivates them – more holiday or more take-home pay with a benefit that enables selling or buying annual leave

Be a standout employer

Attract top candidates and promote a healthy work-life balance with a universally appealing annual leave trading benefit that all can enjoy

Stand out as an employer of choice

Holiday Trading can help attract and retain top candidates, while supporting your employee experience strategy to create a motivational environment for your people. Holiday Trading includes:

Personalised allowance for each employee

Automatic or manual approval

Real-time order value calculation

Customisable application windows

Easy administration in one, centralised platform

The Reward Gateway | Edenred benefits administration platform makes managing salary sacrifice and payroll deduction benefits quick and simple. If you have more than one salary sacrifice product (e.g. SmartTech™, Cycle to Work, Childcare Vouchers) with Reward Gateway | Edenred, you can consolidate them all in one easy to use platform.

Flexibility and choice promote a healthy work-life balance

Employees able to buy extra days of annual leave have greater freedom to do what they love. Whether that's spending more time on holiday, at home with the family or on personal projects outside of work, employees can balance work and life when they have more time off. Plus, they’ll associate those happy memories with the ones who made it possible – their employer.

Featured eBook

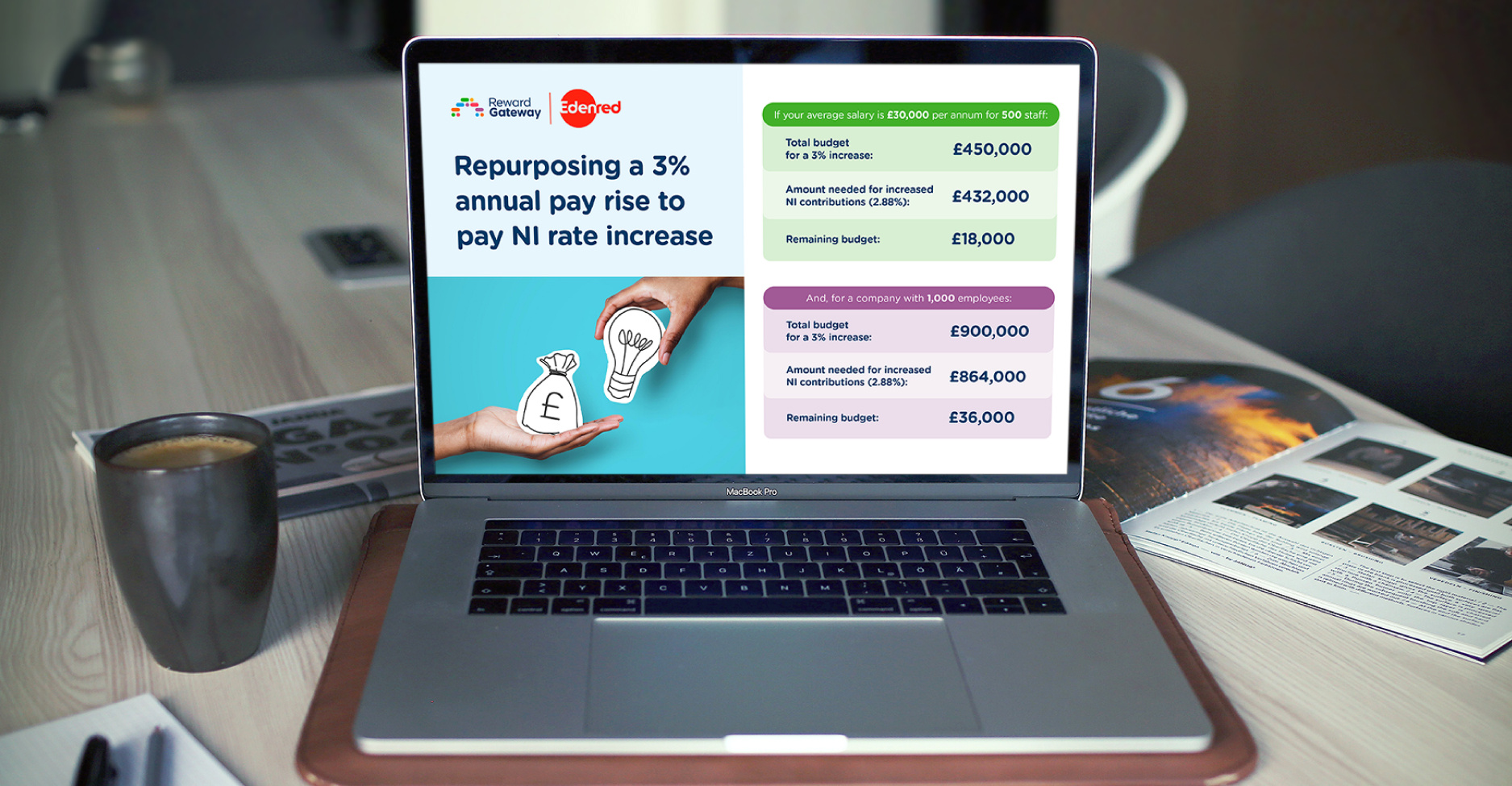

Stretching Pay: Tackling NI Increases

Discover how repurposing a 3% pay rise can offset National Insurance increases and unlock more than £500 in savings per employee annually with industry-leading discounts and benefits.

"Our offline employees love that they can apply for salary sacrifice options on any device, at any time through our engagement hub. It's especially helpful to have a 24/7/365 help desk number in case employees have questions when we're not around."

Discover more Reward Gateway | Edenred client success stories

![[Client Testimonial] DB Cargo](https://www.rewardgateway.com/hs-fs/hubfs/00-Product-Assets-New/UK/Testimonial-mockups/db-cargo-min.png?width=4168&height=3176&name=db-cargo-min.png)

Holiday Trading FAQs

Is Holiday Trading a salary sacrifice or net payroll deduction benefit?

Holiday Trading is a salary sacrifice benefit, with the value of a purchase or sale of annual leave subtracted from or added to their salary payment, pre-tax.

How much can an employee buy/sell holidays for?

The value of your holiday units varies according to the employee’s salary. They will see how much their holiday is worth using the slider on the Holiday Trading application page and can then make an informed decision on how many days to buy or sell.

Will the money for an annual leave sale be paid in one lump sum?

If your employee sells a day or more of their holiday allowance, this can be paid in installments added to salary payments throughout the year, as specified by you.

What happens if an employee leaves the company with an existing balance to pay or receive?

If an employee leaves the company within a payment period, the remaining balance can be subtracted from, or added to, their final salary payments.