Car Benefit

Boost financial wellbeing with an employee car benefit scheme

In partnership with Tusker, the award-winning employee car benefit provider, Reward Gateway | Edenred offers a salary sacrifice car benefit to help support your people’s financial wellbeing. Provide access to a new or pre-loved car or electric vehicle, fully maintained and insured, and generate thousands in National Insurance savings with our employee car benefit.

Give your organisation's overall Employee Value Proposition a powerful boost

Support your employees and stand out in the employer market with a distinct salary sacrifice offering that won't slow your HR team down. Our car benefit can help you:

Support employee financial wellbeing

Make it easy to purchase a brand new or pre-loved car or electric vehicle without the financial burdens.

Offer a unique benefit your people will love

Attract and retain employees with an impactful Tusker salary sacrifice car scheme.

Save big on National Insurance with electric cars

With just 50 electric vehicles now generating reductions of over £175,000 in employer NI contributions, make savings that can help you fund other benefits or HR initiatives.

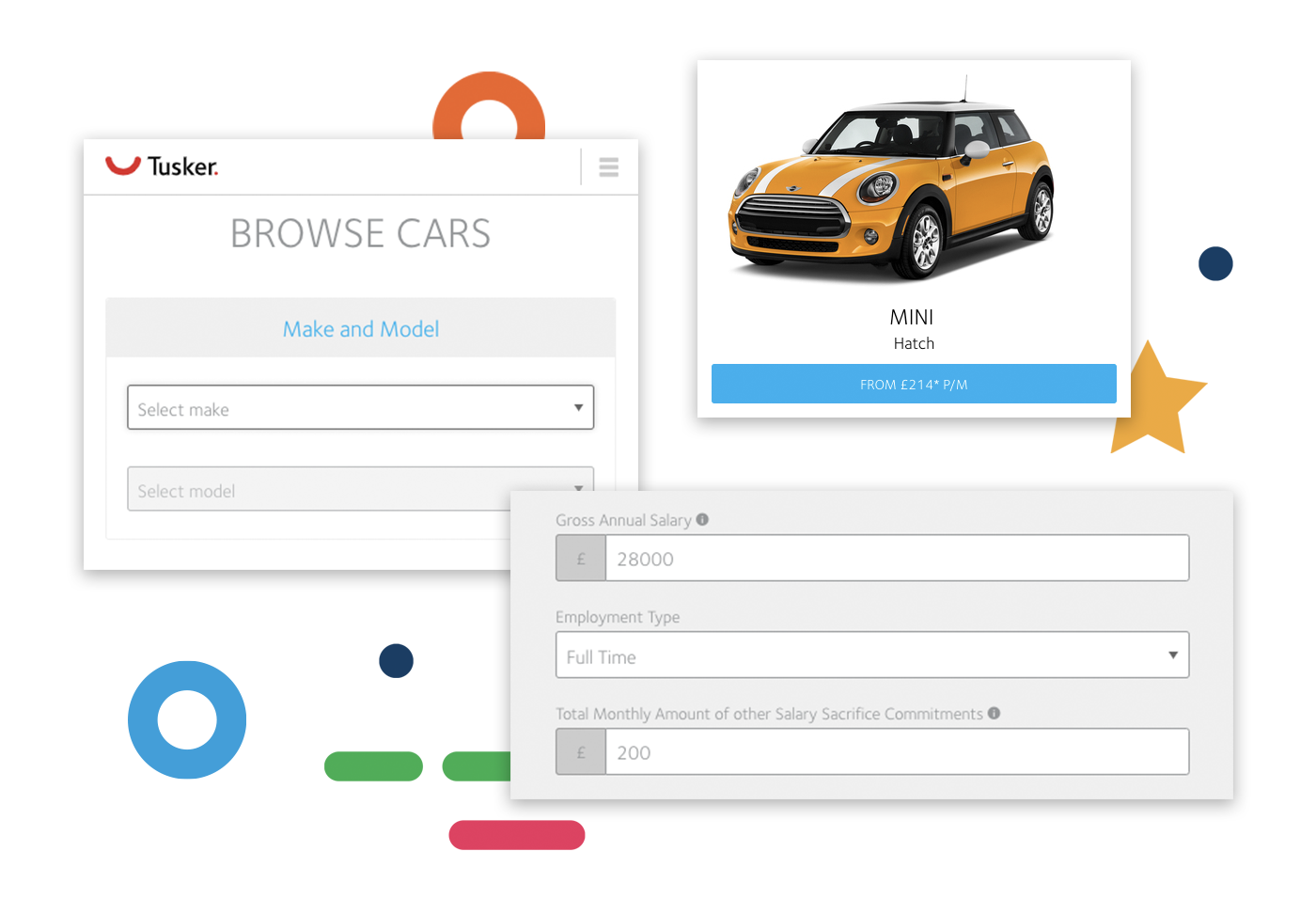

A fully integrated user experience

Employees can seamlessly access Tusker with a single sign-on process through the Reward Gateway | Edenred platform to select and configure the vehicle they want based on their affordability profile. Our car benefits includes:

Personalised allowance for each employee

Two-tier order approval

Real-time order value calculation

Customisable application windows

Affordable fixed-rate schemes

Our Tusker salary sacrifice car scheme provides monthly fixed prices on a new or pre-loved car or electric vehicle – with no deposit required – from the latest brands, including BMW, Audi and Tesla. Tusker’s ‘charge or fuel and go’ inclusive package includes MOT, servicing road tax, breakdown services, replacement tires and even car insurance. And, with the 2030 ban on the sale of new petrol and diesel-engined cars on the horizon, CO2 cars are now safer, more reliable and more affordable than ever before.

Protections for employees and employers

We ensure a worry-free process for both employees and employers with our employee car benefit scheme. Choice is based on affordability so it prevents employees looking at cars they cannot afford. Employers are also protected if an employee resigns, or isn’t working due to a long-term illness or maternity. It’s a great way to provide peace of mind for everyone.

Featured eBook

15 Benefits to Truly Make a Difference in Your Employees' Lives

Looking to offer a benefits package that has a meaningful and positive impact on your people? Learn more in this free resource!

![[eBook] 15 Benefits to Truly Make a Difference in Your Employees' Lives](https://www.rewardgateway.com/hubfs/uk-15-benefits-to-make-a-difference/2024_15%20Benefits%20to%20Truly%20Make%20a%20Difference%20eBook%20digi_UK-feat1.png)

Car Benefit FAQs

What is a salary sacrifice car?

A salary sacrifice car scheme allows your employees to pay a fixed amount of their salary each month in exchange for a brand new or pre-loved car. The amount is taken before income tax and National Insurance, so employees and businesses can save on the contributions they pay. The set monthly amount includes comprehensive car insurance, road tax, breakdown cover, MOT, maintenance, replacement tyres and accident assistance.

Who is the vehicle agreement between?

The salary sacrifice scheme is made between your organisation and the employee, while the vehicle contract is between your organisation and Tusker, the provider.

What is included with a salary sacrifice car?

Fully comprehensive insurance, annual road fund licence (road tax), replacement tyres, routine servicing and maintenance, MOTs, full RAC breakdown cover and lifestyle protections are all included should your employee need to end the agreement early under certain circumstances.

What isn’t included in the scheme?

Our car scheme is designed to offer your employees a complete motoring package, however it doesn’t include fuel, payment of fines, engine oil, AdBlue top-ups outside of servicing, damage due to driver misuse or excess mileage charges.

What happens at the end of the salary sacrifice agreement?

There are three options for employees. They can order another car, which will be delivered as the current one is collected, return the vehicle or buy the car outright for its market value.

Is a deposit required for a salary sacrifice car?

No, a deposit is not required for a salary sacrifice car purchase. The first amount is deducted from the employee’s salary from the month delivery is made. This will be confirmed by the employer.

What happens if employees resign or are made redundant?

We work with employers to offer a range of lifestyle protections should an employees’ circumstances change such as maternity or paternity leave, redundancy, resignation and long-term sickness so that there are no early termination fees due.

"Our offline employees love that they can apply for salary sacrifice options on any device, at any time through our engagement hub. It's especially helpful to have a 24/7/365 help desk number in case employees have questions when we're not around."

Discover more Reward Gateway | Edenred client success stories

![[Client Testimonial] DB Cargo](https://www.rewardgateway.com/hs-fs/hubfs/00-Product-Assets-New/UK/Testimonial-mockups/db-cargo-mockup.png?width=4168&height=3176&name=db-cargo-mockup.png)