We know that spending around the festive season can be challenging, but when we place it against the backdrop of the current cost of living increases, many will struggle this year with day-to-day expenses on top of the gifts under the tree.

According to the Bank of England’s recent reports, a typical UK household spends over £700 more in December compared to other months, but more and more outlets are predicting that Christmas (or any other festivity you may celebrate during the winter months) could come close to £1,000 with inflation, which is approximately more than half of a typical monthly household’s income after tax and pension.

We know that these numbers are staggering for an employee, but this has a knock-on effect on businesses as well, with organisations struggling to do more with less and looking to find impactful benefits and initiatives that positively support their entire workforce.

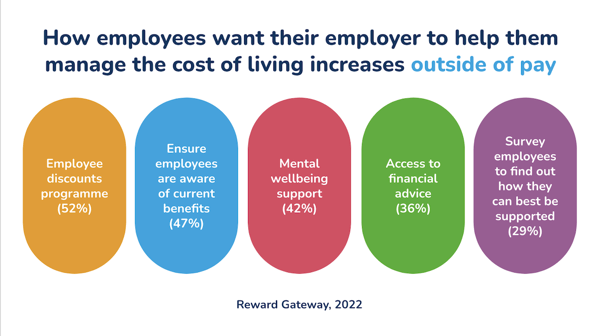

So how can HR leaders help, with their budgets tight and rising costs pressuring the business, as well as the individual? Recent data points to the top 5 ways that employees want their employer to help them manage the cost of living increases outside of pay. Here’s a look:

As you can see, an employee discounts programme and boosting awareness of benefits on offer tops the list. To help put this into perspective, we’ve looked at how the typical family or individual may be spending their hard-earned pounds this year, and how a discounts programme like the one Reward Gateway offers can provide valuable savings when your people may need it most. The even better news is that a programme like ours can be launched in as little as 48 hours.

With over 1,000 global retailers, we’ve helped millions of employees with their big-ticket purchases and everyday savings, with savings from October to January of this past year topping £9.7 million for UK employees in common categories like food and beverage, home decor, gift options for the kids, luxury items and electronics. Let’s take a closer look into how a powerful discounts programme could help your own employees:

Gifts for the little ones

Many employees may struggle to fulfill their children's Christmas gift list this year so a little help with the costs of presents can go a long way. By shopping at a number of our kid-friendly retailers, clients save between 4.5-7% at brands like Disney, Argos, John Lewis, The Entertainer and Early Learning Centre. Last year, this added up to £1.4 million in savings for employees.

Gathering ‘round for Christmas dinner

With UK food price inflation hitting the highest level since the global financial crash, employees will really be feeling the pinch this year with the Christmas food shop. Savings from 4-7% at popular grocers such as Sainsburys, Tesco, Asda, M&S, Morrisons, Waitrose and CoOp and valuable Cashback (10% at CoOp!) could make a huge difference. This provided £2.3 million in savings for employees last Christmas season.

Getting plugged in

Electronics can have a hefty price tag attached, but among the electronic retailers offered on the Reward Gateway employee discounts platform, you can save up to 20% on Dell, and from 3-10% on popular retailers such as Currys, Apple and Samsung. This is where the BIG savings come into play, proven by employees using the SmartSpending platform saving more than £5 million in just one shopping season.

Electronics can have a hefty price tag attached, but among the electronic retailers offered on the Reward Gateway employee discounts platform, you can save up to 20% on Dell, and from 3-10% on popular retailers such as Currys, Apple and Samsung. This is where the BIG savings come into play, proven by employees using the SmartSpending platform saving more than £5 million in just one shopping season.

Depending on your employees’ shopping habits, providing an employee discounts programme can put more money back in your employees’ pockets, without the cost of a company-wide pay rise. What’s more, a discount programme with special savings and Cashback where they’re already buying can help add to their overall savings for moments like end-of-year-costs.

Our client Hilary Bright, Director of HR Services at City College Norwich, never leaves her weekly shop untouched through her employee discounts programme. She says,

I use ‘College Rewards’ to buy a supermarket voucher each week, and with the 5% I save on this I put that equivalent to one side to save especially for Christmas. It provides well over £100 to spend on treats or what I need. It’s really easy to buy the voucher and then save it to my phone to show at the checkout.

Finding more ways to support low-income families

While a discounts programme can help lower costs for the everyday family, recent reports are highlighting the surging energy costs, which could increase by £1,300 per household by October once the energy cap is removed. The Guardian recently reported more than a quarter of households earning less than £20,000 worry they will be unable to cope with higher bills, with one in every eight UK households fearing that they have no more ways to decrease their daily budget.

A benefit like an employee discounts programme can help low-income families with their everyday purchases, stretching an employee’s annual paycheque by up to £1k depending on their buying habits.

If your benefits provider offers savings on utilities or food shopping, that’s one step forward in the right direction. Still, employers may want to consider initiatives like a one-time monetary reward to alleviate some of the costs around Christmas, or collating financial wellbeing resources to quickly and easily share with employees for more ideas on how to save.

If you’re in need of more ideas on how to support employees with the true cost of Christmas this season, please have a watch of our latest webinar, “End-of Year Support & Recognition to Truly Make a Difference in a Difficult Economic Climate,” as I explore more tangible benefit ideas with my colleague Director of Client Cultural Insights Alex Powell.

Joe Benton

Joe Benton