People everywhere are facing real financial challenges in 2022. The cost of renting has soared over the last year. Food and grocery prices have increased by 13.5% over the last year, the largest increase that we've seen since 1979 in the U.S. Plus, there is an upward climb in energy and transportation costs. On top of this, 62% of Americans reported that they struggle to pay at least one bill. So, it is understandable that many Americans are worried about the rise in the cost of living and how far their paycheck will stretch.

What this means to employers is that their staff is stressed and turning to them for ways to make life a little easier in these tough times.

But when employers are faced with equal challenges of increased staff and hiring costs, there’s no easy answer to helping employees when the budget doesn’t allow for it. Yet, even small, inexpensive gestures can make a big difference for employees.

Try these low-cost ways to help support your employees during the cost of living crisis:

| 1. Mental wellbeing support |

| 2. Ensure employees are aware of current benefits |

| 3. Give access to financial advice |

| 4. Implement an employee discounts program |

| 5. Survey employees to find out what support they need |

1. Mental wellbeing support

How employees feel when they are at work has a large impact on their performance and attendance. Even when times are hard, when your workforce knows they have your support and appreciation, they are more engaged. This can be provided by several means.

Employee recognition - where staff can receive and give out thanks for doing a great job or helping out in a tough situation.

Wellness content - where there is informative information provided to help with common issues such as physical wellness, health and nutrition advice, or mental wellbeing for times of high stress.

Leadership transparency - where management and CEOs engage in active employee listening and communication while also providing regular business updates and news.

Giving programs - where companies support worthy causes in their community and around the world.

2. Ensure employees are aware of current benefits

You might be saying that this is a no-brainer, but step back and ask yourself just how much your employees know about the company benefits that are available to them. If there is a low uptake of benefits at your organization, that can be a sure sign that employees are unaware of the programs you have initiated.

Look into how well employee benefits are communicated to your staff. Are there regular company meetings where benefits are discussed? Are there emails sent out periodically to remind employees? Is benefit awareness a part of their daily life? If it’s not, then it costs little to no money to get the word out.

Think of your employees as customers and what methods it would take for them to learn about what you have to offer.

Promote benefits whenever possible. Create benefit guides. Explain why and how the benefits can help them. When employees know what they have access to, the chances of them taking up the benefits and finding relief for some of their challenges can make a huge difference in their performance and engagement.

3. Give access to financial advice

When employees are worried about how they are going to pay their bills, their productivity can suffer. They are more likely to make mistakes due to distractions. Or they may make unfavorable decisions about families, physical health, and career choices based on the financial stress they are under. But offering programs or services that helps ease their worry can alleviate the negative impact on their performance and help prevent them from seeking work elsewhere.

You can do this for employees by:

- Pointing to free money advice sites

- Setting up regular money management classes

- Offering “debt clinics” through HR

- Helping employees save

- Helping employees borrow

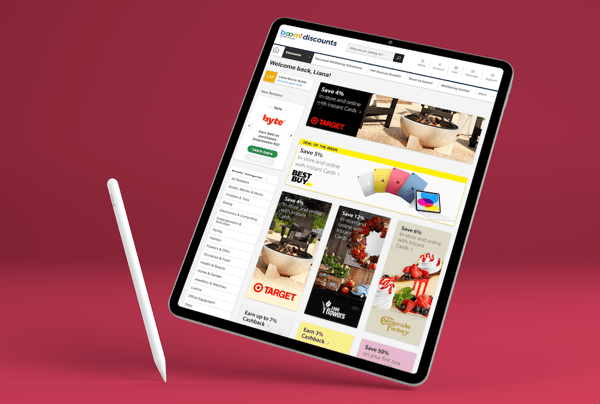

4. Implement an employee discounts program

Finding ways to assist employees with stretching their disposable income is beneficial. That’s how discount programs can help. Since 74% of employees would use any financial rewards received from their workplace for essentials rather than luxuries, an employee discount program can be adapted with the same mindset.

The key is offering a wide range of discounts. Not all employees are the same and have different needs and wants. While a discount card to a popular food chain may be beneficial to some employees, it may not entice others who are more focused on everyday savings for their family or their pets.

The right discounts program can offer a huge variety of savings, such as:

- Discounted books for professional development

- Car washes and oil changes discounts

- Low gym memberships

- Inexpensive pet health insurance

- Free financing on technology options

5. Survey employees to find out what support they need

Always remember to find new ways to listen to your employees. Continue to reach out and ask what your employees need and want through pulse surveys, manager one-on-ones, or group meetings. Consider having a platform that communicates the benefits, shares employee experiences, and makes access to employee benefits easy.

Always remember to find new ways to listen to your employees. Continue to reach out and ask what your employees need and want through pulse surveys, manager one-on-ones, or group meetings. Consider having a platform that communicates the benefits, shares employee experiences, and makes access to employee benefits easy.

When you provide employees with what they really want, they’ll inevitably appreciate the benefits more. It encourages the feeling that you as an employer care about their wellbeing and want to help as best you can.

How to make the most of benefits outside of a pay rise increase

Though employees may have a long wish list, we know that not every item is within the business budget, so it’s important for employers to take what actions you’re able to. It shows that you genuinely care even when you are feeling the cost of living increases too.

If you're interested in learning more ways to help your employees through cost of living increases, get in touch with us, and a member of our team will walk you how our solutions can support your employees.

Klara Owens

Klara Owens