With inflation causing sharp rises across many day-to-day costs, it’s down to employers to support the financial wellness of their people before it leaves a serious dent in workforce health and performance.

According to the latest research from AMP, financial stress among Australians has almost doubled over the past two years. That has a big knock-on effect in terms of productivity, and it's estimated that this productivity loss due to financial stress is costing businesses $66.8 billion.

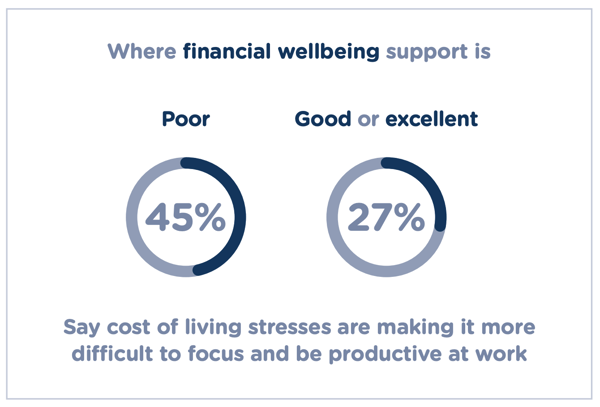

Our recent research echoes these statements, with 45% of employees who rate their wellbeing support as ‘poor’ saying that cost of living stresses are making it more difficult to focus and be productive at work. That’s compared to only 27% of employees who are fortunate enough to rate their wellbeing support as ‘good’ or ‘excellent.’

Of course, employees aren’t the only ones feeling the pinch right now. Organisations across all sectors are looking for pay rise alternatives and new, cost-effective ways to engage staff and promote good financial behaviours. Many have already turned to hybrid and remote working as a way to reduce overhead and develop a more flexible workplace culture – but could this also have a positive impact on employee financial wellness?

We know that hybrid working or working fully remote isn’t possible for all organisations or all employees, but flexible working still remains a must-have for employees in the new world of working.

An all-encompassing employee benefits program like the one Reward Gateway offers can help lessen the financial burdens of everyday costs, no matter where your employees are working, but employers can do more to minimise day-to-day expenses simply by offering hybrid and remote options.

Let’s take a closer look at three key ways in which going remote can ease the strain on your employees’ purse strings.

| 3 ways remote work improves employee financial wellness |

| 1. Cut down commuting costs |

| 2. Reduce childcare expenses |

| 3. Lessen ‘office wardrobe’ spend |

1. It cuts out commuting costs

Avoiding the need to pay for a daily commute to the office is one of the most significant cost savings of remote or hybrid work. It’s not just the cost of bus passes or parking either – people generally tend to spend more on food and social activities when they commute to an office.

Avoiding the need to pay for a daily commute to the office is one of the most significant cost savings of remote or hybrid work. It’s not just the cost of bus passes or parking either – people generally tend to spend more on food and social activities when they commute to an office.

So, how much can employees really save by ditching the need to hop in the car, bus or train every day?

According to the latest Australian Commute Report, Australian employees have an average commute time of 54 minutes per day, and the average daily commute costs an employee $20, with the average yearly cost sitting at $4,003.

Over 7 in 10 commuters say the rising cost of living is impacting their commuting costs, and nearly half of commuters say this is putting financial pressure on their households. Additionally, nearly 3 in 5 commuters agree that the pandemic has somewhat changed their willingness to spend time and money commuting, while almost 2 in 3 agree that commuting time and costs strongly impacts their job choice.

2. It reduces childcare expenses

Childcare costs can be a major burden for families that need to work full-time, yet can’t afford to drop their hours. This is especially the case for lower-wage employees that spend a higher percentage of their salary on childcare, or families with younger infants and children with special needs that require extra care.

Even if it’s for a few days a week, working from home can give parents the option to keep an eye on their children while they get on with their work.

This means they don’t have to fork out thousands of pounds on private childcare and nurseries every year.

When you consider that the national day care average cost is $118.36, the potential impact on employee financial wellness becomes very clear. While new legislation will reduce this cost for some qualifying households, flexible working is a great alternative for others.

Don’t forget that a more flexible model of work allows parents to work around certain times in the day when they need to be available for their children, such as picking them up from school or taking them to appointments. This saves a lot of time and stress involved with making extra arrangements, most of which lead to them spending more money and detracting from their focus on work.

3. It lessens the need to buy ‘office wear’

Most workplaces have a defined dress code, whether it’s formal suits and dresses, smart-casual, designated uniforms, or something else in between.

Most workplaces have a defined dress code, whether it’s formal suits and dresses, smart-casual, designated uniforms, or something else in between.

While the specifics differ from business to business, employees are generally expected to look respectable from head to toe. That means maintaining a wardrobe which can cater for five days a week in a professional workplace. For the occasional shop, my favourite retailers to look at on our discounts platform is Country Road, where we can save 8%!

Appearances are still important for remote workers, of course, though most employees naturally feel a need to look their best in a workplace environment. That pressure can lead to them spending a large chunk of their earnings on shirts, blouses, trousers, shoes and jackets that they otherwise wouldn’t feel the need to buy.

Remote working eases this pressure and helps employees manage the cost of their wardrobe by avoiding the need to purchase new clothes specifically for the office.

Looking for more ways to support financial wellness for your remote employees? Find out more about our range of creative discounts, savings and benefits designed to cut the average employee’s daily costs, no matter where they call ‘work.’

Kaitlin Howes

Kaitlin Howes