I’ve been at Reward Gateway now for three months and not only have I learned lots, I’ve also saved lots.

As someone who has previously been responsible for Employee Engagement and Experience in various HR roles in my career, it’s been amazing to be a newbie again, and experience things from the other side of the fence as an employee (and I’m loving it).

It’s a pretty exciting time in my life. Yes, I’ve started a new job at an awesome company, but also ... my wife and I have another baby on the way. There’s heaps happening!

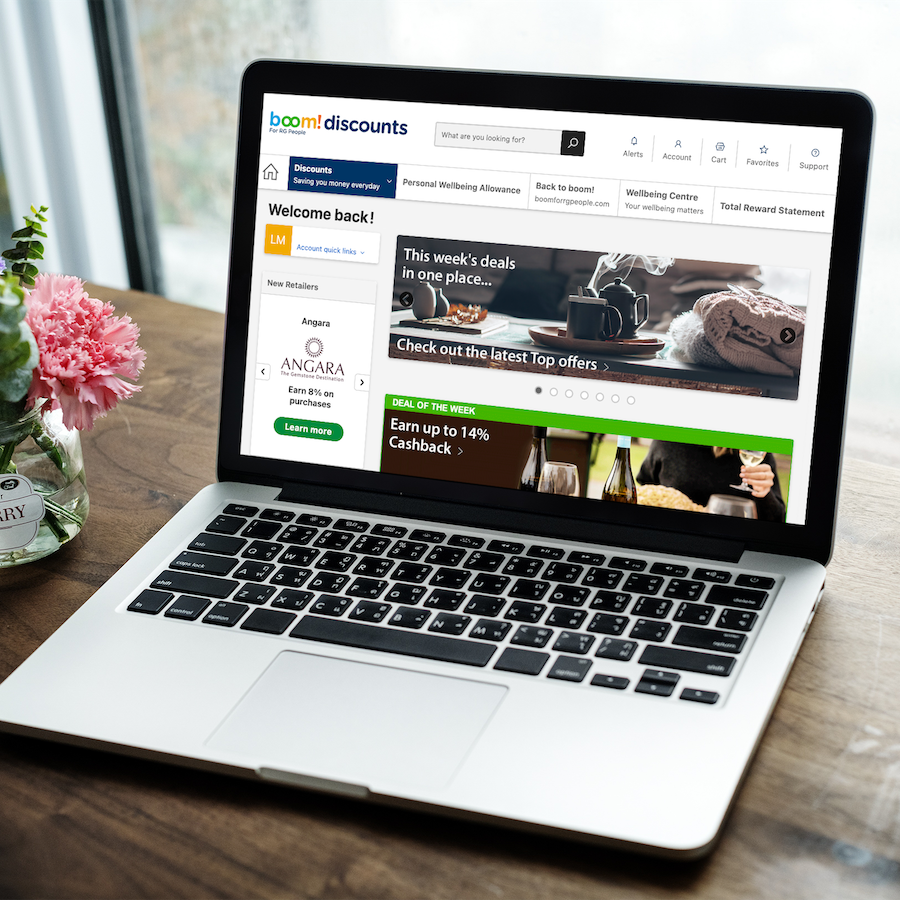

With a new addition to the family, I suppose you could say we’ve become a little more ‘cost-conscious’ in our household. Which is why I’ve paid lots of attention to our SmartSpending™ employee benefits program, where we can get sizable discounts and Cashback that really add up and support our financial wellbeing.

The rising cost of living has put pressure on lots of Australian families recently. Inflation, interest rates, the cost of petrol, materials and groceries are tracking in one direction – up.

Of course, in times like this it’s become even more essential to save where we can. Luckily, the Reward Gateway discounts and Cashback options have allowed me to save a lot of money – and I’m excited to save more in the coming months.

On a weekly basis, I’ve started to save heaps on my groceries (thanks Woolies and Coles) and petrol (cheers Ampol and EG). Though, I’ve also discovered some interesting, timely and out-of-the-ordinary ways to save, too.

So let me now share just a few of my not-so-secret discount discoveries:

1. Home and garden

In my home, we’ve been thinking about ‘nesting’ and getting everything in order for the baby to arrive. You would think (or, at least I did) that would mean getting a change table, bassinet and some nappies. But there’s a little more to it – e.g. we need a fresh lick of paint in the spare bedroom, some child-friendly appliances, and comfortable furniture (an absolute must!). Making this much easier is the discounts we have at Freedom, Target, Myer, Ikea and Amart!

Potential savings: up to 8%

2. Food delivery

Ordering food a couple of times a week can add up really quickly, but what I’ve quickly realised is that apart from grocery deals, our platform also has a handful of ways you can save on food delivery and takeout! Uber Eats, DoorDash and YouFoods come in handy a fair bit. But, if you want to do the cooking yourself there’s Marley Spoon and HelloFresh who also offer discounts.

Potential savings: up to 40%

3. Travel

When we start paying more attention to our budgets, one of the first things we usually try to cut back on is travel and activities. But the good news is that getaways don’t have to be super expensive – which is good, because I’ve promised my wife a baby moon! I’ve had a look at our discounts for travel agencies, airlines and hotel websites and realised that I could save money at Airbnb, Booking.com, Expedia, Webjet, Wotif, Hotels.com, Stayz and many more.

Potential savings: up to 10%

4. Insurance providers

Insurance is one of those things that can feel like wasting money, but is so important to have. Nowadays, you can get insured for basically anything. Whether it’s your home, your car, your electronics or your pets, getting insurance will pay off in the long run. It might not be the first thing you think of when you think of our discounts, but I was surprised to see that we definitely have insurance options! HCF, Medibank, Youi, PetsOnMe and many others have Cashback deals you don’t want to miss out on!

5. Children and toys

We have a four-year-old daughter who is super excited to be a big sister! Of course, birthdays and Christmases are about to get a little more expensive. So, it’s amazing that we have discounts and Cashback offers at BigW, Kmart and Target. Though, we can also save on pretty much every ‘baby essential’ at BabyBunting - and pick out a few matching outfits at Seed or Best & Less.

6. Wellbeing

Although my schedule is certainly busier since having kids, I’m pretty conscious of staying healthy overall. I have a wife, (soon-to-be two) daughters and a dog to keep up with, so I feel extra motivated to look after my wellbeing. Being able to save money at FootLocker, Rebel, My Muscle Chef, Fitness First and Priceline Pharmacy gives me heaps of options to help me maintain my health focus. It feels pretty good that I can invest in myself while still looking after my financial health.

So there you have it. My six secret discount discoveries - and in a time where cost of living talk is everywhere, it’s a little more meaningful and timely to be putting dollars back in my pocket. I can’t wait to see what more I discover in the next three months!

Interested in your own employee benefits program for your people? Pop a message over to our team, and they’ll help you put one in place in a matter of weeks!

Ryan McGrory

Ryan McGrory