Everybody loves to feel like they’re getting more for their money – we’ve all experienced the disappointment of our salary entering our account and swiftly leaving. It’s not always possible to give your employees a salary bump, but what if you could give them that amazing feeling of finding a few extra dollars in their pocket every month?

There are lots of ways you can help employee salaries go further in 2024, whether that’s helping them save money on day-to-day expenses with discounts at their favourite retailers or cashback schemes that reward spending.

According to our latest research, Australian employees chose financial wellbeing as the area that employers should prioritise the most in 2024 with 48% of surveyed employees choosing this option, compared to 32% for mental wellbeing and 7% for physical wellbeing.

With financial wellbeing top of mind for Aussie workers, employers are eager to find tangible ways to help employees navigate the cost of living crisis leveraging innovative financial benefits and programs.

Our on-demand webinar, Boosting Financial Wellbeing: How to Address the No.1 Employee Priority in 2024, delves into this in greater detail, so check it out!

Below, I've explored how financial wellbeing and employee satisfaction intersect, in addition to revealing five clear signs that your organisation needs better financial benefits and an increased investment in employee financial wellbeing.

The link between financial wellbeing and employee satisfaction

Our Workplace Engagement Index found that a whopping 81% of Aussie workers are concerned about the rising cost of living and inflation, and salary and financial benefits topped the list of key workplace concerns (54%). This was highest for Early Millennials at 64% and lowest for Baby Boomers at 45%.

Our Workplace Engagement Index found that a whopping 81% of Aussie workers are concerned about the rising cost of living and inflation, and salary and financial benefits topped the list of key workplace concerns (54%). This was highest for Early Millennials at 64% and lowest for Baby Boomers at 45%.

While different generations of workers may experience varying levels of financial security, over two thirds of employees say that employers should do more to offset inflationary pressures and the rising cost of living.

This is supported by previous research from our employee engagement experts, which found that 38% are considering leaving their jobs due to a lack of financial, physical or mental wellbeing support, and 26% due to a lack of employee benefits.

Most notably, our research found that 53% of employees say stress from cost of living increases is negatively impacting their work.

So, if you’re seeking to boost productivity, retain talent and attract new employees, offer new benefits and support that can help with your people's financial wellbeing.

Signs that your employees may need help with their financial health

| 1. Notice signs of high turnover rates |

| 2. Reported feelings of lack of appreciation |

| 3. Complaints of lack of financial benefits |

1. High turnover rates

Does it seem like workers are constantly leaving? Do new faces continue popping up around the office (or on Zoom calls) every day?

Like a small leak in a great ship, a steady exit of employees can cripple a large company. A high rate of turnover may be indicative of larger issues of employee dissatisfaction and lack of fulfilment, especially when it comes to financial wellbeing at work.

Anonymous surveys can be incredibly useful for gauging employee satisfaction levels. Surveys have the potential to reveal a lot about what employees feel they need to succeed. By simply allowing people to fill out a survey, they may feel their needs are heard and therefore can feel more assured that the company wants to help them in their financial wellbeing.

Anonymous surveys can be incredibly useful for gauging employee satisfaction levels. Surveys have the potential to reveal a lot about what employees feel they need to succeed. By simply allowing people to fill out a survey, they may feel their needs are heard and therefore can feel more assured that the company wants to help them in their financial wellbeing.

Causeway, a technology company with roughly 200 employees, had a robust wellbeing offering but survey results showed increased levels of stress and anxiety among employees. The team took measures to improve employee wellbeing and mental health through several methods:

- Increased communication of benefits and services

- Education around mental health

- Open conversations around personal difficulties

The Causeway team saw their success when new survey results revealed that 90% of employees believe that the company genuinely cares about their wellbeing. Absences from work decreased by 35%.

Without support from their employers, valuable workers may be lost to a steady stream of turnover as the company faces the high cost of replacement.

In the end, high turnover reflects the general health and stability of the company, pointing to feelings of employee under-appreciation due to poor compensation and lack of benefits.

2. Reported feelings of lack of appreciation

Our recent research found that one in four employees rarely or never feel appreciated or recognised. While big salary increases or bonuses may be out of the question for the immediate future, know that employee satisfaction soars when you can say thanks and show appreciation for their contributions.

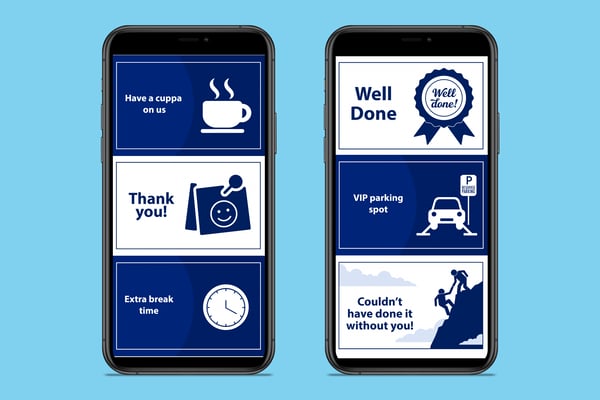

By leveraging employee rewards, Australian organisations can provide monetary help to their people without the huge cost of a company-wide salary increase. Interestingly, we found that 67% of Aussies agree that employees should have the flexibility to choose rewards depending on their life stage and needs versus having a standardised package for all.

Employee rewards not only help improve motivation and transform company culture, but they can also give your people a feel-good financial boost.

Take Kettle Foods for example. The organisation wanted to establish a monetary reward system that could be managed solely by their Executive Team. Working with Reward Gateway, the team tailored the system and granted specific permissions for senior managers to log into the platform, choose a card, write a personalised message and send an employee $25 or $40 for a job well done.

And that monetary reward goes a long way. With the Reward Marketplace, employees can redeem an item of their choice from Amazon at no additional cost, helping them feel the true value of their hard work while giving them the flexibility to choose the reward that matters the most to them.

3. Complaints of lack of financial benefits

Your job also consists of providing employees with financial wellbeing through health and financial benefit programs. Although you may be hesitant to offer money-related benefits to workers, such as financial education around employee loans, it’s crucial to understand how a financially healthy workforce can benefit the company, raising morale and confidence.

While some companies may shy away from providing too much financial support, there are a number of unique financial benefits that can support employee financial wellbeing, including:

While some companies may shy away from providing too much financial support, there are a number of unique financial benefits that can support employee financial wellbeing, including:

- Financial education programs

- Employee loans with salary deducted repayments

- Employee benefits programs

- Employee wellbeing programs

Ultimately, the idea is to take away some of the stress and financial burdens off the shoulders of employees and support them in financial planning, guidance and wellbeing.

When selecting financial wellbeing benefits for your organisation, understand your workforce and their unique needs to find the areas in which you want to focus the most effort.

By recognising the signs that people need support and providing them with the right systems, you’ll make a big difference in their lives. Get in touch with us to learn more about how to support employees’ financial health.

Jon Fulluck

Jon Fulluck